China-US Container Leasing Rates Rise Threefold, Container Demand Recovery on the Horizon

The global shipping industry experienced a significant surge in rates over the past couple of months, as an aftermath of the Red Sea crisis. Three months into this crisis, container leasing rates on the China-US trade route have surged dramatically, rising by a staggering 223%, or threefold, compared to pre-incident levels. Additionally, demand for containers is expected to recover in the coming months as the US economy exhibits signs of resilience.

The U.S. economy has exhibited resilience, with GDP rising at a 3.3% annual rate in the fourth quarter of 2023. This growth was fuelled by gains in consumer spending, non-residential fixed investment, exports, and government spending, among other factors. Furthermore, December’s personal income and spending reports reflected lower inflation and solid household spending, contributing to a positive economic outlook.

Despite economic concerns, China is experiencing a surge in demand for ocean container freight to the United States.

“The gains in consumer spending and retail sales figures suggest that our industry can expect decent demand recovery for goods, which translates into relatively higher container demand on the cards, as retailers restock inventory and fulfil consumer orders.” added Roeloffs.

According to the Port of Los Angeles’ PortOptimizer, Week 6 TEU volumes were up 38.6% compared to the same week in 2023 (105,076 TEUs vs. 75,801 TEUs).

One of the industry participant from a global logistics and freight forwarding company from California, United States shared with Container xChange as part of response to our regular polls around container price sentiment, “As attacks on cargo ships in the Middle East continue and vessels are rerouted around southern Africa, we anticipate equipment shortages due to the lack of container repositioning in Asia for eastbound goods. Furthermore, disruptions in the Suez, Red Sea passage, and Panama Canal will likely lead to increased demand for routing through the West Coast. Many importers are already rerouting cargo via West Coast transloading and trucking across to the coast, adding pressure on railways and domestic carriers. We advise all clients to provide advanced forecasting, considering all routing options proactively, and determining the best course of action based on cargo readiness dates and required on-site dates.”

Another industry professional, a sales representative at a freight forwarding company in the US shared, “Our overseas offices have been reporting massive rate spikes, surging almost to COVID crisis-levels. I wouldn’t be surprised if those levels are reached by the middle of Q2.”

While the prospects of better container demand in the rest of the year have improved, shippers are struggling with issues like container crunch in China, and 3X leasing rates on key trade routes.

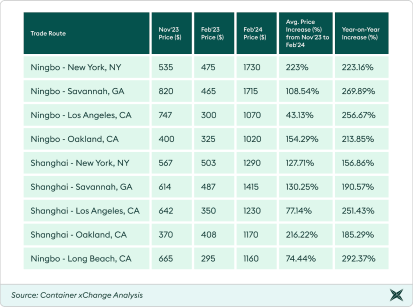

The price hike was especially pronounced on routes Ex China to key destinations like New York, NY and Los Angeles, CA in the United States. (See table below). To gain deeper insights into the cyclical fluctuations of container leasing rates that could have led by the pre-Chinese New Year surge, we conducted a comparative analysis with last year’s leasing rates in February 2023. Our findings reveal a stark contrast, as the magnitude of the current hike was not observed during the same period in February 2023.

* Note: Prices are rounded to the nearest dollar.

Table 1: Comparison of Container leasing rates (in dollars) Ex China to US East Coast and US West Coast Trade Routes: November 2023, February 2023, and February 2024 by Container xChange, an online container logistics platform for container trading and selling

The significant spikes in shipping rates over the last three months signal a notable shift in the supply-demand dynamics, with demand recovery and capacity being increasingly tied up as the transit times via the cape of good hope increase by 2 –3 weeks. While the pre-Chinese New Year surge contributed, it was the disruptions caused by the Red Sea rerouting that served as the primary catalyst for the shooting up of leasing rates for containers.” explained Christian Reoloffs, co-founder, and CEO of Container xChange.

Post Chinese New Year Freight rates expectation

“Freight rates were somewhere around $2000 back in February 2023, last year. This year in 2024, these are at $3392 as on 9 February 2024. These prices last year continued to decline after the Chinese New Year by around 30% until March 2023. If we follow the cyclic trend, then a decline of a similar magnitude in the current freight rates will lead to the prices crashing from $3393 as on 2 February 2024 to $2300 in the coming weeks.” shared Christian Reoloffs, cofounder and CEO of Container xChange, an online container logistics platform for container trading and leasing.

On the China to North America east Coast trade route, freight rates doubled between 15 December 2023 to 19 January 2024, (from around $2500 to roughly $5000).

Shipping lines and carriers may benefit from higher leasing rates in the short term. However, in the long run, if these elevated costs are maintained, it can increase the cost of exporting goods, potentially squeezing profit margins for manufacturers and exporters. They may need to pass these increased costs onto consumers, leading to higher prices for imported goods.

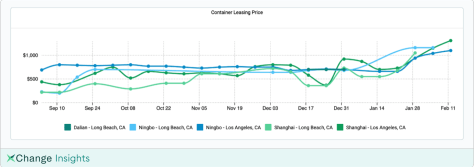

Container Leasing Rates on China-US trade route

The chart below illustrates a sharp increase in leasing rates from China to the West Coast ports of the United States, particularly Los Angeles and Long Beach, in 2024. In December 2023, prices ranged from $280 to $776 for Los Angeles and $370 to $710 for Long Beach.

However, prices surged in January 2024, with rates to Los Angeles ranging from $740 to $920 and to Long Beach from $700 to $920. This trend continued into February 2024, with rates to Los Angeles reaching $1070 to $1230.

Chart 1: Average One-way leasing rates Ex China to USWC ports

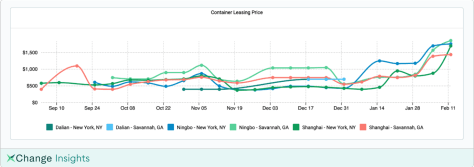

Chart 2: Average One-way leasing rates Ex China to USEC ports

Prices for shipping containers from China to New York and Savannah, GA ranged from $400 to $820 and $590 to $1043, respectively, in September to December 2023. In January, prices rose notably, with rates to New York ranging from $608 to $1008 and to Savannah from $706 to $733. Prices continued to rise in February, with rates to New York reaching $1290 to $1730.

China to New York rates more than doubled from December 2023 to February 2024, while rates for shipping containers to Los Angeles increased by nearly $435 during the same period.

To read similar analysis, reports and indices, visit Container xChange’s Market Intelligence hub

Leave a Reply